Let’s talk about how to track business mileage using Mile IQ!

As creative entrepreneurs, we’re always on the move. Can we get an amen? We go from one place to the next so fast that –– by the end of the day –– we forget where we’ve even been! Some of it’s personal, like a trip to get groceries. Some of it’s business, like a client meeting, portrait session or wedding day. But it’s all a lot to keep track of and remember!

With all the combinations of personal and business drives, tracking mileage and keeping it all straight gets to be close to impossible –– which stinks, because then you’re stuck with either a) losing money by not tracking business mileage at all, or b) tracking it wrong and risking a red flag on an audit.

One thing you need to know about us is that we’re big time rule-followers. (Especially Amy. So much so that she actually wore her retainer (almost every day) when she got her braces off in high school. Who does that?) Neither one of us liked to get into trouble as kids, and not much has changed –– especially when it comes to the IRS! –– which brings us to how to track business mileage… without really having to keep track of anything or being worried about an audit.

We Used to Track Business Mileage… on PAPER.

We used to track business mileage on paper. On paper, you guys. Partly because we’re frugal and didn’t want to buy a “fancy app,” and partly because we’re stubborn, and once we’re doing something “our way,” we like to do things our way! Can you relate? We had a small binder for it and everything. Every time we drove anywhere for business, we wrote down our starting and ending mileage. It wasn’t a big deal most of the time, because Jordan drives and Amy’s in the passenger seat, so she was the dedicated mileage tracker. She’s also the in-car editor, Instagram-poster, email-responder and so much more. She makes good use of that passenger seat!

Remembering to track business mileage on paper wasn’t that big of a deal. Until we were running late. Or Amy was on the phone. Or we were in the middle of a great conversation. Or we forgot. That’s when it became a problem. Why? Because the mileage didn’t get written down! So, then, at the end of the month, we had to use Google Maps to put in our starting and ending location for wherever we’d been on November 11, 2017 to get the miles we’d driven. If we’d been multiple places on the same trip on the same day and some of it was personal and some of it was business, the math wasn’t fun! Trust us. And we’ve never been very good at math.

The App We Use to Track Business Mileage

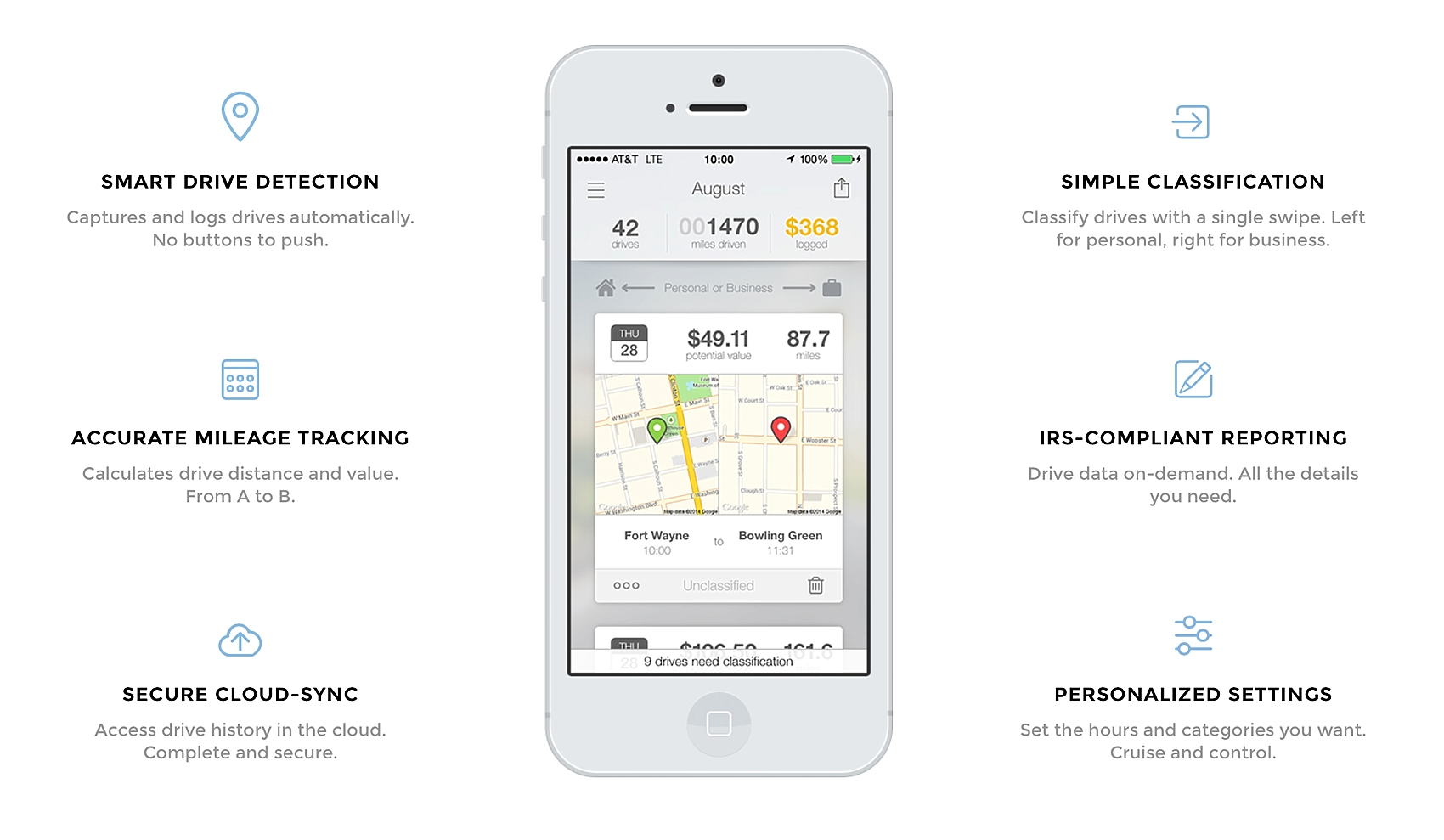

The solution? We switched to Mile IQ! It’s an app for your phone that runs in the background (so it’s always working and you just don’t realize it) to track every drive you make from point A to point B. How does it do it? We’re not engineers –– so we don’t know! –– but we can tell you that it works! About fifteen minutes after your drive is done, if you open your Mile IQ app, a map will pop up showing you where you started and where you ended for each individual drive –– even if they were in the same errands trip. If it was a personal drive, you just swipe to the left (you just swipe to the left!) and Mile IQ saves all the data for you in the cloud until you need it. If it was a business trip, you just type a quick comment describing the purpose of the drive, because, from what we’ve been told, the IRS requires that you state in writing why your trip was a business trip. You might hear others recommend just marking business drives as “business,” but remember, we’re rule-followers, so we’ll go the extra mile 😉

Your comment about the trip doesn’t need to be a complete sentence or even have punctuation, so don’t give it much thought, just use our system: what + who + where. It’s a little bit like the board game Clue. For example, “Amy and Jordan with the candlestick in the library!”

Just kidding.

Real-Life Examples

Here’s a real-life example: bride meeting with amy taylor at starbucks. That’s it! We write it in that order because it takes longer to write names with apostrophes and capitalization on phones like: Amy Taylor’s Client Meeting at Starbucks. That might be a little too Type-A for you, but we’re all about being as fast and efficient as possible with everything we do, because the seconds add up to minutes. FAST. (Here’s a link to a post that will help you save more time every day!)

Here’s a quick word of caution, though: Make sure to swipe your drives every night or whenever you’re just sitting around killing time. If you wait until the end of the month, you WILL forget some of the places you went, and then you’ll be searching through your iCal (like we were!) trying to remember.

At the end of the month, Mile IQ will email you a report in either Excel or PDF with a list of your personal and business drives (we just do business) dated, time-stamped, with all of your comments, the number of miles and — here’s the best part! — the value of the drives all totaled up for the month. Cue confetti! No math involved!

How to Make Money from Your Miles

As of 2018, the IRS says that every mile you drive is worth 53.5 cents reimbursed. So, if you drive one hundred miles for business in a month, the value of those drives would be $53.50. But what do you do with that number once you have it? Well, there are a few options! And, like Olmec from Legends of the Hidden Temple always says, “The choice is yours and yours alone.” Also, let us preface this by saying that we’re neither accountants nor tax attorneys (Jordan dropped out of law school after about seven weeks), so we’re just sharing what we do, so, like those horrible prescription drug commercials they play during football games and the nightly news, consult with a professional before use! Especially since everyone’s tax-filing situations are different, our way might not be the best way for you. Taking a deduction at the end of the year, instead, might put more money back in your pocket when your taxes are filed, said, and done.

Deduct or Reimburse?

With that in mind, since our business is an LLC S-Corp, for legal and tax reasons, we’re both employees of Amy and Jordan Photography. For mileage purposes, it means this: Every time we drive our personal vehicle somewhere for business, our employer, Amy and Jordan Photography, is legally allowed to reimburse us for up to 53.5 cents per mile (as of 2018). Commutes don’t count, though. It’s just for jobs that require you to drive your personal vehicle above and beyond your daily commute, which for us is currently the kitchen table to the coffee maker most days, at least until the mail comes! Jordan LOVES getting the mail. What’s nice is that the money isn’t included as taxable income since it’s a reimbursement, just like if we bought something for our business on our personal debit card (on accident) because we didn’t look at the card number when it was actually for business. No big deal! We’d just write a check from our business account to us to fill that hole.

Long story short, friends, if you don’t have it yet, get Mile IQ! It’s only $5 per month (or one latte!) and WELL worth it! Because, if there’s one thing we’ve learned about being small business owners, it’s this: time is money, and there’s a limited amount of the first, so anything that saves us time AND makes us money is something we’re interested in! Our only regret about this app is that we didn’t get it sooner.

Save 20% on Mile IQ Today!

If you want to do a free trial of Mile IQ to track business mileage, click here. When your trial is up, you’ll be able to save 20% on a new one-year subscription using our promo link.